Choosing the Right Insurance Policy for Independent Truckers

Wherever you go out for something, too many options will blow your mind; in that situation, choosing what to choose is difficult. For independent truckers, selecting the right insurance from Independent Coastal Trucking Insurance Agency Ohio is not just a legal requirement; it's a vital safeguard for your business and livelihood. With many insurance options available, finding the policy that best suits your needs can be complex. Here are some tips and guidance to help you navigate this crucial decision:

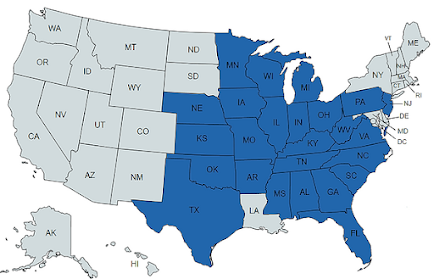

Assess Your Risks and Needs First: Determine your own needs. Take into account the kind of cargo you transport, the distance you cover, and the states in which you do business. Your choice of insurance will be based on this comprehension.

Meet Legal Requirements: Ensure that you adhere to all state and federal laws and the Department of Transportation's (DOT) minimum insurance standards. Heavy fines and penalties may be imposed for failing to comply with these rules.

Work with a Specialist: Independent truckers may consult with an insurance agent or broker specializing in covering commercial trucks. They can help you through the procedure because they are skilled and knowledgeable.

Coverage Types: Become familiar with the various coverage Independent Trucking Insurance Agency Florida offers. Typical choices include cargo insurance (covering the products you transport), liability insurance (covering bodily injury and property damage), and physical damage coverage (protecting your truck).

Evaluate Deductibles: A deductible is the amount you must pay before your insurance coverage begins. While higher deductibles may result in reduced premiums, they will also result in higher out-of-pocket costs in the event of a claim. Find a balance that works with your spending plan.

Policy Limits Review: Keep a close eye on the policy limitations. Check to see if they are sufficient to cover any potential liabilities. In the case of a severe accident, inadequate coverage could leave you without enough financial protection.

Consider Additional Coverages: You may require additional coverage, including uninsured/underinsured motorist coverage, which safeguards you if you are involved in an accident with an underinsured or uninsured driver, depending on your specific situation.

Research Insurers: Find Reputable Insurance Companies: Look for insurance companies with a track record of settling claims fairly and offering helpful customer care. Check out reviews and ask other truckers for advice.

Inquire About Discounts: Find out what discounts are offered. Some insurers provide savings for your truck's safety features, driving history, or grouping multiple policies (like auto and cargo insurance).

Conclusion,

Choosing the appropriate Independent Coastal Trucking Insurance Agency Ohio is crucial to running an independent trucking company. You can make an informed choice that protects your business and your peace of mind on the open road by evaluating your needs, familiarizing yourself with coverage alternatives, and consulting with specialists.

.jpg)

.jpg)

Comments

Post a Comment